AI-Enabled Loan Origination for NBFC

Executive Summary

A leading non-banking financial company (NBFC) partnered with a global System Integrator (SI) to digitize and streamline its loan origination process across personal loans, SME lending, and two-wheeler financing. Synaptron was brought in as the specialized AI and platform delivery partner, providing domain-aligned developers, data engineers, and ML consultants.

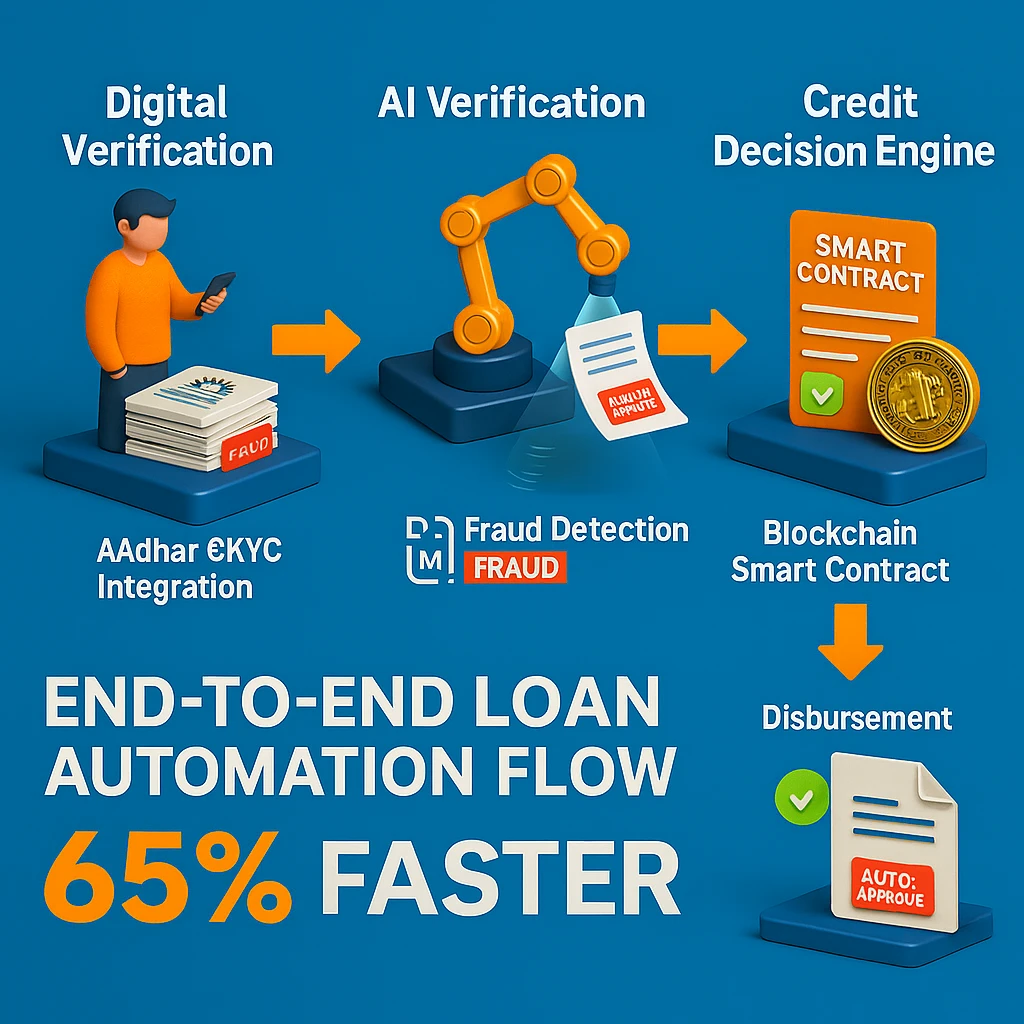

Through this joint engagement, Synaptron developed and supported an AI-powered loan origination and document automation engine, delivering:

- 65% faster loan application processing

- 80% automation in document verification

- 30% improvement in onboarding conversion rates

- Full auditability and compliance with RBI digital lending guidelines

This solution now powers paperless, real-time credit decisioning across 4 lending categories for the NBFC.

Challenge

High Application Volumes, Fragmented Verification, and Manual KYC Bottlenecks

As the NBFC expanded into semi-urban and digital-first customer segments, it faced key bottlenecks in scaling:

Application Spikes Delayed Processing and Conversion

Application overload during monthly campaigns led to delayed processing and lost leads

Manual Document Checks Slowed Verification

Manual document checks (ID, income proof, utility bills, bank statements) increased human error and verification delays

KYC Inconsistencies Triggered Compliance Issues

KYC inconsistencies across channels (branches, DSAs, digital onboarding) caused compliance flags

High Drop-Offs from Long TAT and Poor Communication

Poor lead-to-loan conversion due to long TAT and unclear status communication to applicants

Limited Risk Visibility for Underwriters Pre-Disbursement

Limited visibility for underwriters into risk indicators before disbursement

The business needed a robust, AI-first platform to digitize intake, validate submissions, and reduce reliance on manual touchpoints—without compromising risk governance.

Solution

Loan Origination Automation – Engineered by Synaptron via SI Partner

Working under the SI’s digital lending transformation program, Synaptron deployed a team of specialists who co-developed and operationalized the core components of the automation platform.

Modules Developed and Managed by Synaptron:

- Digital Application Interface

-

- Omnichannel forms for customer, DSA, and branch-led onboarding

- Integrated with credit bureau APIs, Aadhar EKYC, and PAN validation tools

-

- AI-Based Document Verification Capsule

-

- OCR & ML models extracted fields from ID proofs, salary slips, and bank statements

- Liveness detection and facial match with selfie for fraud prevention

- Contextual rules triggered red flags for tampered or low-quality scans

-

- Rule-Driven Credit Scoring Framework

-

- Dynamic scoring engine consuming bureau score, income-to-loan ratio, location risk flags, and profile completeness

- Automated routing to approval, manual review, or rejection buckets

-

- Agent Dashboard and Workflow Tracker

-

- DSAs and underwriters tracked each case’s status, missing docs, risk flags, and TAT SLAs

- System auto-escalated stuck files and sent reminders to applicants or sourcing agents

-

- Compliance & Audit Layer

-

-

- All verification steps, overrides, and decisions logged with timestamps

- Data masking and retention policies aligned with RBI’s digital lending regulations

-

Outcome

Digitized Credit Operations with Embedded Intelligence

Delivered jointly through the SI and Synaptron teams, the platform achieved:

- 65% Reduction in Processing Time: Personal and SME loan files processed in <2 hours, down from 6–8 hours average

- 80% Straight-Through Document Processing: AI verified most applications without human input, with a fallback queue for edge cases

- 30% Higher Lead-to-Loan Conversion: Faster decisions and better applicant communication led to more completions

- Reduction in KYC and Onboarding Errors: Facial match and real-time validations reduced rejections at disbursement stage

- Improved Credit Risk Visibility: Early-stage decision flags and scoring transparency enabled better portfolio control

Future

Expanding AI-Driven Lending Across New Channels

Synaptron continues to support the SI in building additional capabilities for the NBFC’s lending roadmap:

Voice-Assisted Onboarding

for underserved and low-literacy customer segments

AI-Driven Cross-Sell Models

based on applicant behavior and transaction history

Voice-interface Real-Time Fraud Monitoring Dashboards

integrating signals from underwriting, collections, and repayments

Integration with India Stack

(Account Aggregator, DigiLocker) to enable full-paperless MSME lending

Disbursement Automation with Smart Contracts

on eligible financing schemes