AI-Driven Claims Processing

Executive Summary

A top-tier insurance company engaged a reputed System Integrator (SI) partner to modernize its claims processing function. The SI brought in Synaptron as a strategic delivery arm to architect, build, and implement an AI-powered claims automation platform. Synaptron deployed a specialized team of solution architects, data scientists, and full-stack engineers to co-create the solution from ground up.

Delivered through our SI partner, the platform resulted in:

- 50% reduction in claims processing turnaround time

- 40% drop in manual intervention across retail policy types

- 25% increase in fraud detection accuracy

- Rollout across 3 lines of business within 9 months

This engagement highlights how Synaptron’s deep BFSI expertise and scalable resource model deliver tangible outcomes within large-scale transformation programs.

Challenge

Manual Claims Lifecycle, Long TAT, and Fragmented Operations

The insurer’s existing claims process relied heavily on human-driven interpretation and fragmented systems:

Manual Claims Validation Slowed by Errors and Delays

Manual validation of claims documents was error-prone and time-consuming

Unstructured Inputs Causing Data Inconsistencies

Lack of standard formats for inputs like hospital bills, FIRs, or surveyor notes created data inconsistencies

Operational Overload from Static Team Capacity

Operational teams were stretched, managing growing volumes with static bandwidth

Inadequate Early Fraud Detection Leading to Reversals

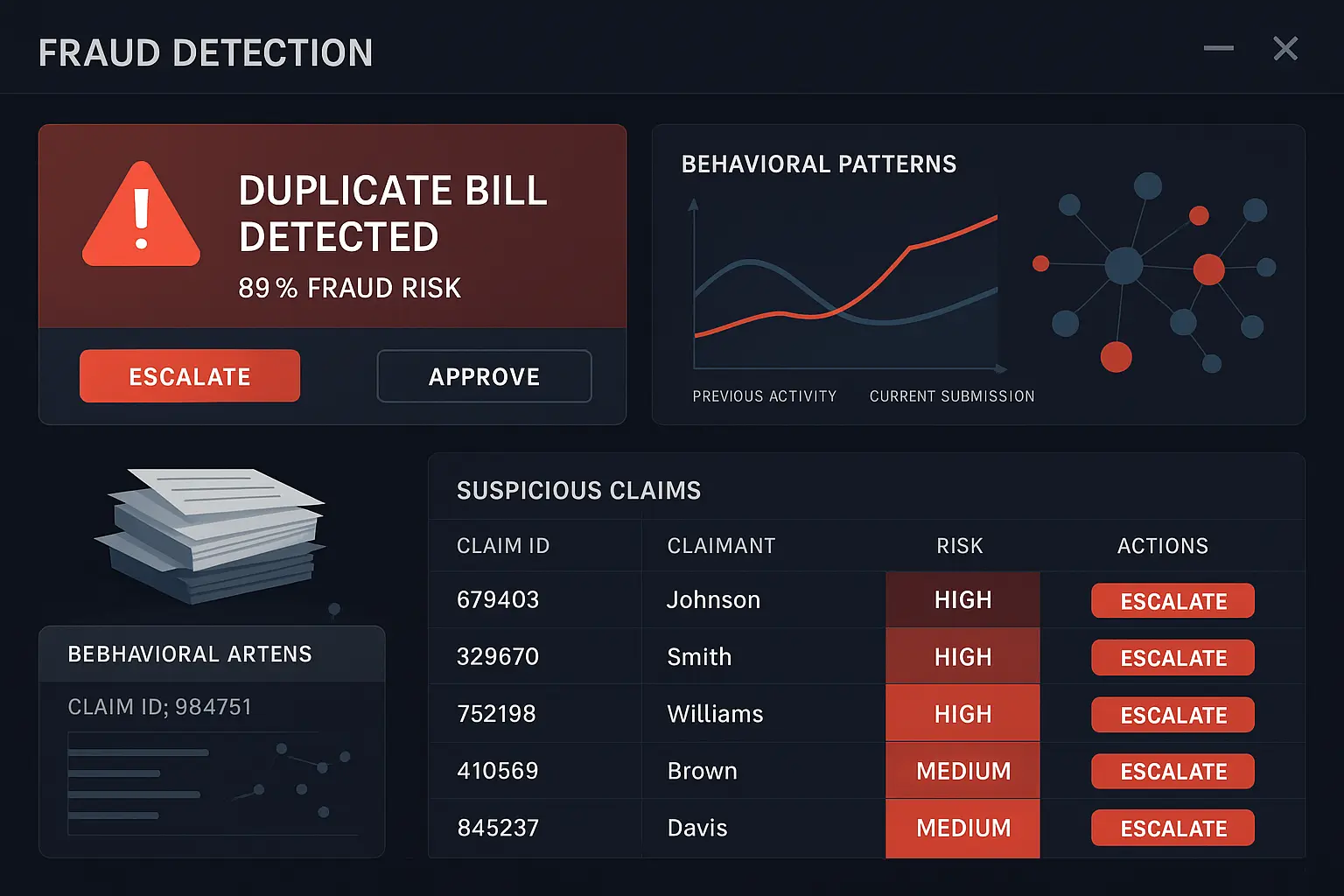

Early-stage fraud checks were insufficient, leading to claim reversals post-approval

Limited Visibility and Auditability in Decentralized Workflows

End-to-end visibility and audit tracking were difficult across decentralized workflows

The client mandated an AI-first, compliant, and scalable platform—with agile delivery from an experienced implementation ecosystem.

Solution

End-to-End AI Claims Automation – Co-Developed by Synaptron via SI Partner

Under the leadership of the System Integrator, Synaptron delivered the core AI components, workflow engines, and user-facing layers of the platform. Our team worked from both client site and offsite agile pods to execute the following:

Key Modules Developed by Synaptron:

- AI-Powered Document Intelligence

- OCR + NLP-based pipeline to extract structured data from scanned and digital documents

- Tagging logic mapped fields to internal policy validation rules and submission checklists

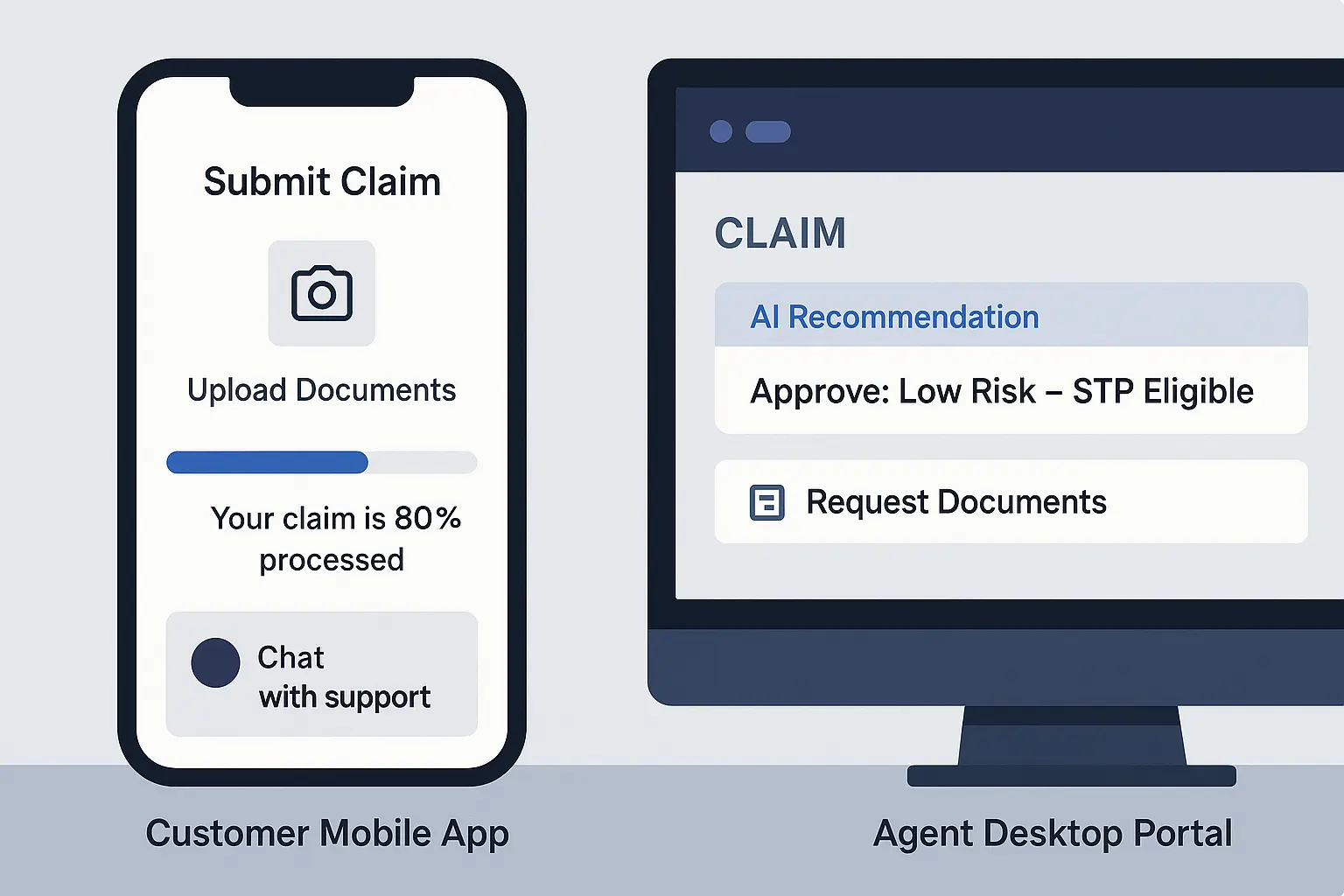

- Smart Claims Decision Engine

- Built a configurable rule engine for eligibility checks, payout ceilings, and exception triggers

- Enabled STP (Straight-Through Processing) for low-risk claims under defined thresholds

- Fraud Analytics Module

- Machine learning models flagged anomalies based on behavior patterns, prior claims, and document inconsistencies

- Integrated with a dynamic alert queue and investigator dashboard

- Agent Portal & Customer Interfaces

- Developed lightweight, mobile-responsive portals for direct submission, live tracking, and document re-upload

- Integrated with back-office BPM and policy admin systems for seamless workflow transitions

- Compliance & Security Layer

- Aligned to IRDAI guidelines, with encryption, audit trails, role-based access, and logs for every user interaction

Outcome

High-Impact Claims Transformation Through Partner-Led Delivery

Delivered within a collaborative framework, the solution delivered exceptional business outcomes:

- 50% Faster Claim Turnaround: Reduced average time from 5+ days to <72 hours

- 40% Reduction in Manual Workload: Auto-validation and STP removed effort from common claim types

- 25% Increase in Early-Stage Fraud Identification: AI flagged suspect claims that were missed in legacy workflows

- Positive Feedback from Internal Teams: Greater transparency, less rework, and unified dashboards improved user experience

- Successful Multiline Rollout: Motor, retail health, and group health lines went live within 9 months

The platform is now considered a benchmark deployment within the client’s transformation roadmap, with further modules planned through the same partner-led model.

Future

Platform Expansion with Synaptron Co-Engineering

Synaptron continues to work alongside the SI partner in evolving the solution stack:

Conversational AI for Claims Support

Deploying domain-trained bots to assist customers and agents with submission and FAQs

Analytics for Claims Forecasting & Pricing

Enhancing data science capabilities to influence product development

Integration with EKYC & IRDA Portals

Streamlining onboarding, verification, and claim adjudication

Pan-India Deployment

Extending to regional subsidiaries and bancassurance partners